MidChains OTC Desk

Experience enhanced liquidity and a bespoke, private service tailored specifically for institutions and high net-worth individuals

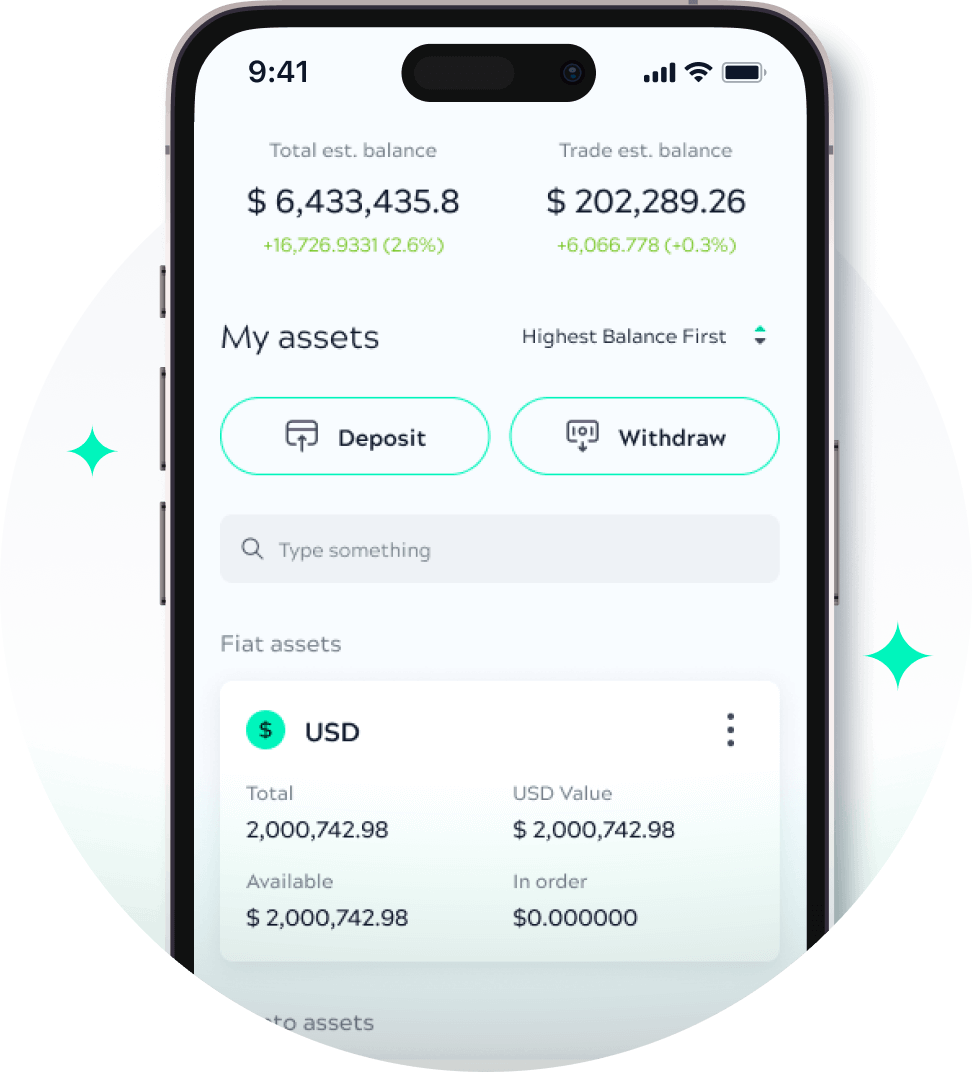

Trade OTC with MidChains

MidChains OTC Features

Discreet Execution

Designed to avoid a frenzy of algorithmic trading and/or an uptick in the crypto market

Deep Liquidity

Gain access to deep liquidity when executing your trades with MidChains

Settlement Choices

Receive your assets in your bank account and/or external wallets

Security Controls

Secure customer experience and leading security controls

Cost Effective

Access institutional grade pricing from global liquidity pools, market makers, and other providers

Bespoke Service

Dedicated client services with a company that values partnerships as part of its culture.

MidChains OTC Products

- For trade sizes USD 50,000 and above, get a quote and execute trades via MidChains’ verified communication channels.

- Access perpetual swaps in most pairs in the market allowing speculative traders to take directional plays in larger amounts than they would be able to in the physical market. This is a bespoke solution offered on a case by case basis*

- Vanilla Options

We have access to a deep pool of liquidity in OTC Crypto options, limited to the top twenty coins by market cap. We are able to quote short dated or long dated options and can tailor a solution to fit your needs* - Exotic Options

We understand you may want to be able to find better value in the options strategies, by using the volatility curve dynamics. We are able to offer barrier or rebate options to allow clients to express their views in a cost effective manner*

- We offer a range of high yielding structured deposit notes where you may benefit from enhanced yields up to 60% per annum.

- Principal Protected:

We offer principal protected structures where your worst case risk is the yield on offer, but the best case is that all conditions are satisfied during the term of your note and you will benefit from an enhanced yield. - Principal at Risk:

We can also tailor structured notes for clients who are willing to take some risk on their deposit notional and provide a variety of solutions tailored to your risk tolerance. The Yield on these products are higher than any other product*

These services are provided by MidChains Trading and MidChains Options and Futures. High risk products where you may lose more than your initial deposit. Midchains Group will not be held responsible for any losses incurred and as a result will conduct a client suitability survey prior to offering these products.